Comments due by Nov. 1, 2014

More household wealth in America sounds like good news, but it could also mean economic trouble.

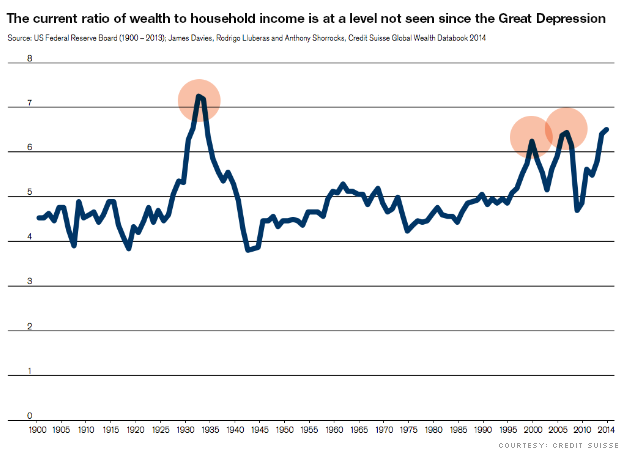

The ratio of wealth to income has hit a recent record, according to Credit Suisse.The last time it was this high was during the Great Depression. And it came close two other times: 1999, the year before the dotcom bubble burst, and leading up to 2007, before the housing market crash.

Wealth has skyrocketed, driven mainly by the soaring stock market, and that has mostly benefited the rich. Income for the average person, meanwhile, hasn't been growing much.

Credit Suisse analysts found that the ratio of wealth to income is 6.5. For more than 100 years, it has typically fallen between 4 and 5.

"This is a worrying signal given that abnormally high wealth income ratios have always signaled recession in the past," the Credit Suisse report said.

Wealth per adult in the U.S. has risen every year since 2008. In fact, average wealth is now 19% above the pre-crisis peak hit in 2006, the report stated. And $31.5 trillion household wealth has been added to the U.S. since 2008.

While experts said it's normal for wealth to outpace income, especially after a recession, it becomes a problem when it rises so fast that people feel overly optimistic about their wealth.

Tim Yeager, chair of the Arkansas Bankers Association, said when wealth inequality increases, the likelihood of asset bubbles also rises.

"Stock market and financial industry wealth are always moving around looking for the highest returns and makes bubbles more likely," he said. "When the stock market gets hot, more people pour in and that amplifies the creation of a pending bubble.

Russell Price, senior economist at Ameriprise, is hopeful the income side of the equation will balance out soon. "The pockets of slack in the labor market are evaporating and job growth is very encouraging - both are needed to increase wages."

The fact that there's been three periods of high wealth to income ratios in 15 years has Yeager concerned. "These asset bubbles are becoming more frequent and that causes financial instability."

Federal Reserve Chair Janet Yellen said in a speech Friday the increasing inequality could dampen the economy. "It is no secret that the past few decades of widening inequality can be summed up as significant income and wealth gains for those at the very top and stagnant living standards for the majority," she said.

14 comments:

If these trends have been noted and economists and claiming that it might lead to another recession, then that is news that people should know in order to save and prepare themselves for the possibility of being laid off. The inequality part of wealth in relation to those at the top of the wealth and income percentages, gaining when they invest in the stock market merely shows that they are doing research as to what stocks will do well and are truly paying attention. While those at the lower parts of the income percentage might be unknowingly putting their money in something that might not do well because they have not done any, or little research on the trends of that area of the stock market.

The American people must begin to educate themselves on the trends of recessions and become involved in the process that affects them first hand, instead of just relying on information once it comes out to the general public.

Beverly Levine, I wrote the first comment, I forgot to put my name on it.

This article speaks on the ratio between wealth and income. This ratio is so high the only other time it was this high was during the great depression. It might seem like a good thing that wealth is rising, but that is only true for the rich meanwhile the middle-class's wealth has been stagnant. The previous other times this has happened a recession occurred. The problem with getting so much wealth is that people feel like they have more money than they actually do. This creates a bubble and pretty soon that bubble could pop and we could be right back into a recession. Especially with the rise in inequality of wealth it seems more likely that the bubble will pop, however others think its normal for wealth to outpace income. I guess we will find out soon what will happen whether the economy gets better or worse.

This article discusses the problem with National Income. National Income has hit a record high this year. This is due to inflation and the stock market. But this increase in income does not entirely mean that everyone in the United States is getting paid more. In fact most average Americans are not earning more money. All of this money is going straight to the pockets of the wealthy people. This again is causing the gap between the rich and the poor to increase. It is also causing people who may have lower incomes to spend more money then they have. When society hears that the amount of national income has increased people assume that this means that money will be rolling into their homes in no time. This is not the case. Although our income is getting higher, average day Americans incomes are not. But the rich are defiantly seeing this increase in income.

Marissa Cotroneo

National Income is at its peak, but not just every average person is getting an increase in salary, it seems to be mostly those who are ALREADY wealthy.The article repeatedly states that the only people gaining income are those who are already of wealth for a reason. Though it sounds great that our economy is doing well, it is actually terrifying to most, because National Income can only go so high, before the United State's history, starts to repeat itself by going into a recession. The rapid rise in National Income has the rich thinking they can spend more and more money, which often leads a lot of the rich to bankruptcy. Even though the income is so much higher, the low-middle class Americans see yet the slightest increase in salary, if that. Most of the wealthy are often also very intelligent and strategic, which leads to the article speaking of stocks. Middle class people maybe do not care enough to research and take chances with the money they have, leaving them in their "comfort" zone, financially.

The ratio between wealth and income is going to be a serious problem. With the credit Suisse saying that along with this show signs of a recession is not good news. Also the income to wealth being the highest its ever been is not good. Wealth is always good to have, but that is only for a small number of people. The income is a more important aspect because if the total income is growing that helps out middle and lower class people. An increase in wages is needed and with that a great number of jobs are needed to be filled. These two things can help the wealth and income gap ratio get set back to where the country is comfortable. If not the US could be set into another recession with the wealthy with no problems and the poor with all the income issues.

Bryan Rivers

This article discusses the wealth to income ratio in the US and how it has reached a recent high. It also discusses how although increasing household wealth may sound beneficial it really isn’t when the income levels aren’t increasing as quickly.

Hearing that the household wealth is increasing at a rate substantially faster than the income rate is troublesome since historically a high wealth income ratio has been followed by a recession. This is also extremely alarming today since the US economy is still recovering from the Great Recession in 2007. Additionally, I agree with Tim Yeager, we should be concerned not only that we are currently at a high but that the frequency of these highs has increased. In addition, being that economic history has shown us that as the wealth to income rate increases so does the likelihood of asset bubbles, I have to disagree with Russell Price and his extremely optimistic opinion on the ratio of wealth and income eventually balancing out. As there are no policies in place to balance out the wealth and income ratio, expecting it to balance out on its own is not rational or probable.

National income has hit a record high this year. Although the wealth is rising, it is only rising for the wealthy. It seems that the middle class is stuck in one place while the wealthy are enjoying the top. People seem to be unhappy about these stats, the fact is that income is not equal either in this country. A lot of work needs to be done to level the playing feel and get the middle class at a better state.

National income has hit a record high this year. Although the wealth is rising, it is only rising for the wealthy. It seems that the middle class is stuck in one place while the wealthy are enjoying the top. People seem to be unhappy about these stats, the fact is that income is not equally distributed either in America. A lot of work needs to be done to level the playing feel and get the middle class at a better state.

This article discusses the correlation with income and wealth. As one would think, increased wealth should be a good thing for our country, but this is not the case. The only group that benefits from this increased wealth is the upper class of the United States. Income has been stationary for the past few years and the last time there was such a high wealth to income ratio, there was the Great Depression. Not only is this concerning for that matter, but this problem must be solved in order to improve from the massive recession that occurred several years ago. The economy not only needs to avoid anther recession, but must improve to help the middle class recover from the Great Recession. Something must be done in our economy to avoid this potential hole we might be in as a country from this wealth to income ratio.

There is a major difference between wealth and income. Income is how much money you make, while wealth is how much money you have. This article talks about the fact that wealth is increasing at a faster rate than income in America once again. The ratio has not been this high since the times of the Great Depression. It is important to close the gap between income and wealth because there will be more of a balance of money in the economy. Right now, one percent of the population holds roughly half of the wealth in the United States, which is a big problem.

-Nick Bellantese

The article talks about the inequality of wealth in the U.S. This issue is the one of the most important issues in the U.S because there are a lot of people who wants to gain equality, especially to those people who are struggling to support their families. The factors that contributes to inequality are wealth and opportunity. The distribution of wealth and opportunity is unfair because people who have money (wealthy people) tend to keep their money and increase their wealth everyday while people who are below the poverty line stays where there are and struggles to help their families. Government should step forward and help those who are in need and stop the inequality in the U.S.

The ratio wealth to income is at an abnormal high, which according to the article is worrying because in the past such ratios have lead to recession. The problem is that some expert believe that such growth is normal and people continue to be optimistic about their wealth and continue to invest in the stock market; creating more frequent asset bubbles which could cause financial instability. If we already know that such ratio trends can mean economic trouble, why there isn’t a plan in place to control it? When we have a recession who suffer most are those with lower and middle class wealth and not those at the top.

I believe that the situation between the distribution of wealth and income is a huge problem. If income does not rise as fast as "wealth" rises it will lead to a recession. If this situation continues people better prepare to lose their job. People should start saving money from now.

Post a Comment