Comments due by Sept. 18, 2015

For most Americans, paychecks determine living standards. Unfortunately, wages in America have long stagnated or declined for most working people, including college graduates.

The disappointing employment report for August — in which wage growth showed no sign of accelerating — only drove home that reality.

Worse, flat or falling pay is self-reinforcing because it dampens demand and, by extension, economic growth. In the current recovery, median wages have fallen by 3 percent, after adjusting for inflation, while annual economic growth has peaked at around 2.5 percent. At that pace, growth isn’t able to fully repair the damage from the recession that preceded the recovery. The result is a continuation of the pre-recession dynamic where income flows to the top of the economic ladder, while languishing for everyone else.

Policy makers should be focused on strategies to raise wages, but the opposite appears to be happening. Just as Congress enfeebled the economy by switching too soon from stimulus spending to budget cuts, Federal Reserve officials have all but vowed to begin raising interest rates this year. That move reflects a belief that the economy is returning to “normal,” but it would be premature, because today’s norm is an economy that is incapable of generating and sustaining broad prosperity.

In a healthy economy with upward mobility and a thriving middle class, hourly compensation (wages plus benefits) rises in line with labor productivity. But for the vast majority of workers, pay increases have lagged behind productivity in recent decades. Since the early 1970s, median pay has risen by only 8.7 percent, after adjusting for inflation, while productivity has grown by 72 percent. Since 2000, the gap has become even bigger, with pay up only 1.8 percent, despite productivity growth of 22 percent.

Why has worker pay withered? The answer, in large part, is that rising productivity has increasingly boosted corporate profits, executive compensation and shareholder returns rather than worker pay. Chief executives, for example, now make about 300 times more than typical workers, compared with 30 times more in 1980, according to the Economic Policy Institute. Other research shows far greater discrepancies at some companies.

For younger people, pay has actually declined. The average hourly wage for recent college graduates in early 2015 was $17.94, compared with $18.41 in 2000. That “loss” in starting pay, about $1,000, can carry over to diminished earnings for years to come. Young high school graduates have it even worse. Their average hourly pay was $10.40 in early 2015 versus $11.01 in 2000.

The Fed is a crucial player in reversing those trends, since one of its mandates is to foster full employment. Wage stagnation is a clear sign that the economy is not at full employment, which means it needs loose monetary policy, not tightening. An interest rate hike, by sending the wrong signal of economic health, could make it harder for labor groups and policy makers to assert the urgency of their efforts to raise pay.

In the past year, low-wage workers have successfully fought for minimum wage increases in states and cities. Congressional Democrats have championed legislation to raise the federal minimum wage and to fight wage theft and abusive worker scheduling. The Labor Department is moving ahead with a much needed new rule to update the nation’s overtime-pay laws.

In the midst of those efforts, it would be a setback for the Fed to act as if the economy is already near full employment. It’s not. The proof is in the paycheck.(NYT Editorial 9/7/2015)

22 comments:

This article only reminds me of what me and so many people my age (and those living on it) want: a raise in minimum wage. It is said in he article that:

"In a healthy economy with upward mobility and a thriving middle class, hourly compensation (wages plus benefits) rises in line with labor productivity. But for the vast majority of workers, pay increases have lagged behind productivity in recent decades. Since the early 1970s, median pay has risen by only 8.7 percent, after adjusting for inflation, while productivity has grown by 72 percent. Since 2000, the gap has become even bigger, with pay up only 1.8 percent, despite productivity growth of 22 percent."

Lord knows it's hard as hell to get a job straight out of college, let alone one that can pay minimum wage (that mostly being because of the baby boomer generation, but that's a different story altogether). For those who have jobs that pay minimum wage, most of them depend on that job for their living, and the ~$7.00 they're getting is barely paying for their groceries, let alone all of the other stuff they need to pay for. A raise is desperately needed across America.

-Elizabeth Piper Phillips

This article is an exact representation of every students worse fear. The article discusses how wages have been decreasing as time has passed. As a time has gone on the percent increase of pay has decreased from 8.7% to 1.8%. Median of wages have decreased form 3% to 2.5%. For college students the hourly wage of jobs has decreased from $18.41 to $17.94. High school graduates have it worse. The hourly wage for them has decreased from $11.01 to $10.40. It seems the government haven't been taking the step in the right direction to increase wages. Instead Congress has prematurely decided to switch to stimulus spending to budget cuts and raising interest rates. This would work if the economy was in a state where it was ready to return back to normal, however currently the economy isn't at that point because it is unable to sustain a broad prosperity. Therefore the congress needs to rethink their approach in resolving this problem. There is only so many strikes and campaigns citizens can do in order to increase wages.

-Surina Sandhu

According to the article "The average hourly wage for recent college graduates in early 2015 was $17.94, compared with $18.41 in 2000. That “loss” in starting pay, about $1,000, can carry over to diminished earnings for years to come."

Reading this made me really think of how much of a struggle recent college graduates are going to experience. College graduates are struggling to find jobs right when they get out of college. As time goes by wages are decreasing and that's very scary. It is already difficult enough for certain people to pay their living expenses imagine those who are in debt because they took loans to go to college. The government needs to react fast other wise it's going to hurt a lot of people.

- Chelsy Ventura

It seems as if everything that the government is attempting to do to assist poor wage and interest rates, is only deepening the problem. The government is very concerned with achieving full employment, however the stagnation of wages is preventing that from being a possibility. The immense loss in pay for graduating college students is scary. It is very difficult to make a living and knowing that young adults are making less and less after college is discouraging. It is almost as if the government has their priorities mixed up as well. According to the article, "The Labor Department is moving ahead with a much needed new rule to update the nation’s overtime-pay laws. In the midst of those efforts, it would be a setback for the Fed to act as if the economy is already near full employment." They are trying to "improve upon" other issues such as overtime pay, as oppose to correcting wage percentages. I think the nation's economy can only get worse if the habits of the fed remain the same.

Current students in the United States have a very scary future ahead of them if the government didn't react. According to the article "The average hourly wage for recent college graduates in early 2015 was $17.94, compared with $18.41 in 2000. That “loss” in starting pay, about $1,000, can carry over to diminished earnings for years to come." Also having in mind that most students are already in huge debts because of the student loans they need to take to finish their education, so are they going to be able to pay their loans back and spend on "basic" life needs? While the fed is busy achieving the full employment and increasing the interest rate, they are only digging deeper and deeper into the problem.

The circular flow of income is calculated as Y=C+I+G+(X-M). Thus the statement that the economy is not at full employment due to low wages can be discussed. The workers who are earning low wages have a a high marginal propensity to consume and a low marginal propensity to save. This means that they spend almost their entire income and save very little. This would result in less injections into the economy as Saving(Investments) are low.If the workers were to get an increase in wages they would be able to save more money which would results in higher injections that with be inested in the economy causing the economy to reach full employment.

Look at five decades’ worth of government wage data suggests that the better question might be, why should now be any different? For most U.S. workers, real wages — that is, after inflation is taken into account — have been flat or even falling for decades, regardless of whether the economy has been adding or subtracting jobs.

-Frank Americo

when this article speaks about how the average college salary decreases throws up red flags for me. The price of college isn't decreasing and with that the opportunity cost is increasing and that is not good. Students will come out of college with debt and now it is only going to take them longer to pay these loans/debt back.

-Nikolas Fountis

According to the article, the average hourly wage for college students has decreased almost a dollar since 2000. This decrease does not seem large enough to impact a college student greatly, but with already having thousands of dollars in debt from student loans, these students are only going to have a tougher time paying off their debt. The Labor Department is too busy focusing on the nations overtime pay laws that they are neglecting to correct the wage percentages. College is only getting more expensive, while wages are decreasing. The nation's economy needs to react to this situation before they dig the economy into a deeper hole.

-Jane Kasparian

In college, every penny counts so when the average hourly wage for college students decreases by a dollar since 2000, the college students of America are at a disadvantage. With student loans being as plentiful as they are today, jobs are needed by many to help stop the piling on of debt. The government and banks want people to pay back loans as soon as possible but when you don't have the funds or even the capability the process is prolonged. I believe there should be more focus by the Labor Department on college pay and much less on overtime pay laws.

-Anthony Abbondanza

No body wants to work more and make less money in return. It's just not logically right. And according to this article, "Since the early 1970s, median pay has risen by only 8.7 percent, after adjusting for inflation, productivity has grown by 72 percent." That is ridiculous, productivity had increased nearly 10 times more than pay. "Since 2000, the gap has become even bigger, with pay up only 1.8 percent, despite productivity growth of 22 percent." In today's society people need more money because things are expensive. With only a 1.8 percent pay increase it's not enough for the average american or college student to survive. Yet they are working at maximum capacity. However, raising minimum wage will only lead to more money in the economy which means more inflation. Everyone likes more money but at what cost? The federal government needs to establish a system to try to figure it out before the national debt continues to spiral out of control.

-Nick Arciszewski

If the interest rates increases, it will give more working class Americans more money in their pocket. It will take time but with more money in the consumers pocket, the more likely they are to spend it on something worth their value. With that taking place the flow of money to the producers will help stimulate the economy by having more cash flow for everybody. This will affect everybody in America, the working class, college students, and upper class. With more small amounts of money in peoples pockets they will feel comfortable in their current standing. They will use the money to invest, produce, and buy.

-Alexander Shields

Raising min-wage in order the get the economy going by more savings and more spending’s from the lower class can be discussed. There is a lot going for that argument but also against. What I think should be done is change of taxes, by lowering taxes on the low income people, essentially it will have the same effect for them as raising the wage. At the same time the businesses won’t feel the pressure to cut jobs like they would have if the wages would have gone up. Were that federal money would come from instead is discussable. I would argue that it’s for society’s best interest that the wealthiest took the blow for the poorest.

It's very unfortunate that wages have decreases over the past years. This directly affects us as college students because we will already be at a disadvantage straight out of college. I think that the Government should raise wages and interest rates slowly while consumers buy more product that they can afford. If people felt more comfortable buying goods, it would mean more money in the pockets of producers, which leaves more room to raise wages. It's very simple, but as time goes on wages and interest rates will be back to normal. If no one was selfish with their money and everyone was willing to give just as much as they take whether they're rich or poor, wages and interest rates would both be at an agreeable amount.

This article causes me to become angry, it makes me want to fight for the middle class. Unfortunately, in the United States, the people with the money dictate where the money goes, which is not completely unjust. The only issue with that is the people with the money have become very greedy and in accordance have damaged the economy and the flow of money itself. While they are getting extremely rich, the middle class and the minimum wage is hurting. We are not growing as a whole, instead only the small percentage is growing vastly while the large percentage is hurting. If the economy where to really flourish all aspects of the economy would grow together. All aspects being the unemployment rate, minimum wage, GDP, labor, production, and most importantly a thriving middle class! The small percentage is thriving while the everyday person continues to struggle. I feel that this problem reflects the behavior of our upper class and the government itself. I believe things will change one day and the middle class will soon thrive.

-Marvin Jean-Baptiste

I beileve that there is not one fix to the problem of decreasing wages. People are fighting for the minimal wage to be raised but that won't fix it. I think that all wages should be raised and the greedy CEO's, cheif executives, and other boss's should take a small decrease in their pay check. They are making 300 percent more than the average worker. If the middle and lower class are paid more money then our economy and employment will start to grow more again. This is because the majority of people are middle and low class and they do not have enough money to spend. They are just barely making enough money to live a comfortable life. Once they make enough money to buy more wants and not only needs, it will put more money into the economy and business will thrive, therefore needing to higher more employees. That will make a continuous snowball effect forcing our economy to fourish and grow.

-Matthew Golden

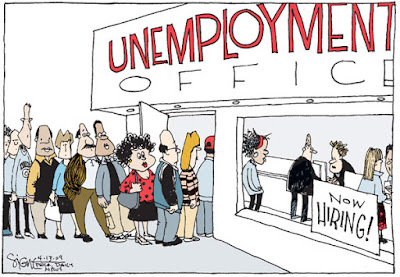

Unfortunately this article is too true. All of these CEO's need to help out with this problem. The only way to fix this problem in my opinion is for greedy CEO's to help inject their wages into the workers wages. Due to the majority of workers being in the middle and lower classes the information that we read upon in todays age only pertains to how those classes are doing. This article and cartoon are also unfortunate because they really italicize how college students are doing when it comes to their hourly wage. This is terrible because I am a college student in high demand of a good paying job. Looking at the information which is very pessimistic but realistic, its a very hard pill to swallow.

In the united states there has been a serious rise in inflation thus causing the dollar to have a lesser value. Some people believe that raising the minimum wage will help the lower class, or recreate our non existent middle class. But that is not a solution first we need to fix our inflation problem and bring back value to our dollar because raising the wages will only add fuel to the fire. Right now i am nervous myself because out of college i need to find a good job to pay debt off of myself but with the recent inflation rate on the rise the likely hood of that happening are extremely slim.

Being a college student the information that was given is frightening.This article is a scary reminder of how the wage growth shows no sign of an improvement in the median wage. Actually, what has been proven is an increase in the gap between the middle and upper class. Throughout time there has been a unpleasant situation in which the recession has continued to effect everyone except the upper class. There are less jobs and the jobs that are out and available to people has decreased in their overall income. In conclusion as the article says so beautifully "the proof is in the paycheck". The government has the ability to increase the minimum wage which is correlated to unemployment rate that we have in America. Until the government does increase the increase the minimum wage there will never be full employment in America.

Post a Comment