Comments due by Oct 9, 2015

When Venezuelan Oil Minister Juan Pablo Pérez Alfonso resigned in 1963, he blasted the Organization of Petroleum Exporting Countries, at the time torn by internal rivalries, for failing to produce any benefits for his country. Half a century later, OPEC is still split and Venezuela is again unhappy, this time at the unwillingness of the organization’s top producer, Saudi Arabia, to rescue oil prices from a six-year low that’s dragging the battered Venezuelan economy into an even deeper crisis.

On Sept. 10, Venezuela’s oil minister, Eulogio del Pino, tweeted appeals for OPEC and non-OPEC countries “to have a discussion on fair prices, minimum prices to ensure sustainability” and to “overcome our differences of opinion.” Venezuelan President Nicolás Maduro said on Sept. 16 that he was making progress on organizing a summit of petroleum exporting countries to have that discussion. OPEC member Algeria is backing the Venezuela-proposed conference—as well as Maduro’s desire for a higher price. Venezuelan officials didn’t respond to requests for comment.

Maduro’s plans won’t pan out unless Saudi Arabia stops flooding the market. There’s no sign it’ll retreat from that strategy, which is helping it preserve and even gain market share. “OPEC is of no use today,” says former Algerian Prime Minister Ahmed Benbitour. “The war now is about market share, not price, and Algeria is getting no benefit from this organization.” OPEC declined to comment for this story.

Venezuela’s and Algeria’s complaints raise the question of why some members stay in OPEC if the Saudis call the shots and ignore pleas for higher prices. Neither Venezuela nor Algeria has made moves to quit. Not only is the group intact, but former member Indonesia is returning, boosting membership to 13 nations.

Disgruntled members “don’t leave because they still believe there could be something in the future where the group does make a decision” to boost prices and cut production, says Jamie Webster, an oil analyst at researcher IHS. “It’s much easier to just keep OPEC alive than to shut it down, and with it a key communication channel” among governments whose financial health depends largely on oil income.

Of the 1.7 trillion barrels that remain to be extracted worldwide, 1.2 trillion, or 70 percent, are controlled by OPEC’s current members. Venezuela and Saudi Arabia hold 18 percent and 16 percent, respectively, and Iran and Iraq 9 percent each, according to oil major BP. These four nations, with Kuwait, are OPEC’s founding members.

“Just look at the outlook for oil in the next 10, 20, 30 years. It is expected that OPEC countries will actually have to come up with most of the growth in supply to meet the demand,” says former OPEC Secretary General Adnan Shihab-Eldin of Kuwait. “If OPEC didn’t exist, it would be needed in the future much more than in the present or the past” to coordinate production and keep the world supplied.

Pricing has often been a bone of contention, with Algeria, Iran, Iraq, Libya, and Venezuela pushing for higher prices, a hawkish stand compared with Saudi Arabia and its neighbors Kuwait, Qatar, and the United Arab Emirates. “Venezuela’s position within OPEC is to pursue a strategy of low production and high prices, since they can’t attract investments” to boost output, says Carlos Rossi, president of Caracas-based consulting firm EnergyNomics. Gulf Arabs are more inclined to accept a lower price to keep consumers hooked on cheap gasoline and thus extend the Age of Oil. Saudi Arabia in particular is more likely to accept a lower price that preserves global growth and gives it influence far in excess of its actual economy. Says Ed Morse, Citigroup Global Markets managing director: “Saudi Arabia’s economy is the size of Illinois’s.” Yet the nation sits at the same table as China, Europe, Japan, and the U.S. thanks to its role as the major producer.

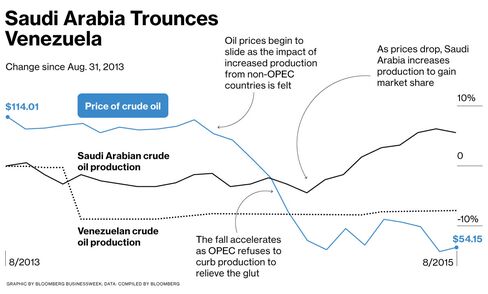

Instead of lowering output to prop up prices, as suggested by Algeria and Venezuela, Saudi Oil Minister Ali al-Naimi lobbied his OPEC counterparts in November 2014 not to yield market share to competing suppliers, including U.S. producers of shale oil. Crude sank and trades at about $50 a barrel, half its level a year ago. “What OPEC wanted to do is have a fresh look at the structural changes that have taken place in the oil market with the advent of U.S. shale and other producers, who at a very high price were able to bring in fresh supplies that far exceed what demand called for,” says Shihab-Eldin.

Algeria’s and Venezuela’s attempts to recruit non-OPEC producers in an effort to increase prices have been rejected by Russia and Mexico, two of the largest exporters outside the group. The Mexicans say their focus is on restoring the productivity of their biggest field. Russia says it doesn’t have the ability of some Persian Gulf producers to quickly raise or lower output because of the harsh winters and complex geology at its Siberian oil fields. “You cannot regulate productivity of Russian wells simply by turning a faucet,” Sergei Klubkov, exploration and production analyst at Moscow-based Vygon Consulting, said in an e-mail.

The International Energy Agency says Saudi Arabia is winning the fight for market share, driving higher-cost producers—for example, some U.S. shale companies—out of business. Non-OPEC supply is expected to fall in 2016 by the most in more than two decades as producers shut wells that can’t operate profitably with oil below $50 a barrel. Production outside OPEC will fall by 500,000 barrels a day, to 57.7 million, in 2016, the agency said on Sept. 11.

That’s no solace for those in OPEC who are hard-pressed for cash. Fresh supply is likely to hit the market from Iran next year, when the oil export ban is lifted as a result of the July agreement with the U.S. and the other Western powers restricting its nuclear program. Oil prices could drop to as low as $20 a barrel, Goldman Sachs said on Sept. 11.

Saudi Arabia’s production of about 10.5 million barrels a day is its highest ever, and the kingdom still has spare capacity of more than a million barrels. Other OPEC members are pumping less oil as projects to bring fresh crude to the market were derailed or delayed by political or social unrest. Venezuela is producing 2.5 million barrels a day, vs. a peak of 3.7 million in 1970. Algeria and Nigeria are in similar straits.

Those three nations, plus Iraq and Libya, are the OPEC members most vulnerable to political turmoil as cheap oil hammers their currencies and weakens their ability to sustain social subsidies. Venezuela “appears poised for a near-term crisis” amid protests and shortages of basic goods as December’s parliamentary elections get closer, analysts Christopher Louney and Helima Croft of the Royal Bank of Canada said in an August report on OPEC’s “fragile five.”

“OPEC is like a family where the children quarrel but can’t do without each other,” says Karin Kneissl, a Vienna-based university lecturer on energy politics and author ofEnergy Poker. “They know they are better off talking to each other to preserve the common, long-term interest; even those who left long to return if they can.”

Indonesia voluntarily suspended its OPEC membership in 2009 as its production declined to the point that it had to import oil. Indonesia still pumps oil for its domestic market. It will return officially on Dec. 4 as the first member that isn’t a net oil exporter. As OPEC’s only member in East Asia, Indonesia could help strengthen the group’s ties in the region, where oil demand is strongest, said Indonesian Energy Minister Sudirman Said in June. As both oil consumer and producer, it will help OPEC bridge the divide between the two groups, he said.

“The benefits from staying with the group outweigh by far the cost of membership,” says Hasan Qabazard, chief executive officer of Kuwait Catalyst and former head of research at OPEC. “Getting firsthand access to market data, research, and information that may affect the market” could be “the motivation behind Indonesia’s application” to return.

“I don’t see OPEC falling apart,” says Fayyad Al-Nima, Iraq’s deputy oil minister for extraction. And Venezuela’s reason for sticking with the group? Says Carl Larry, head of oil and gas for market researcher Frost & Sullivan: “It’s either stay with OPEC and tag along or leave OPEC and be by yourself.”

The bottom line: Saudi Arabia manages to impose its will on other members of OPEC, thanks to its ability to flood the market.

20 comments:

Over the past few years, the price of oil has been on the decline. Recently, oil is at an all time low. At under $50 a barrel and dropping, many producers of oil don't expect to see the same numbers from oil as in the past. This is because countries under OPEC can't seem to come to an agreement to cut production of oil in order for the price to re-stabilize. With prices dropping and production increasing, the price will continue to plummet. However, the demand for oil continues to increase. Leaders of the OPEC market are attempting to recruit non-OPEC countries in the hope that it will help drive of prices. However, with the price of oil being so low, it is not worth it for some of these countries to continue the production of pumping oil. And with the demand for oil increasing, the OPEC countries will continue to match supply and the prices will continue to drop as countries lower their nuclear programs. However, these countries inside of OPEC greatly rely on the production of oil because that is their main export. Therefore, they will stay inside of the organization because it's either be with OPEC or be by yourself.

-Nick Arciszewski

OPEC is the power in international oil affairs, similar to how the United States is the world’s super power – both are hegemonies in their field.

The article states that Saudi Arabia is evoking dominance over the other OPEC members. Why is Saudi Arabia the dominant state among the other members how do you determine who is the most powerful and therefore influential state? I define power as the ability to influence others.

My analysis of the power system within OPEC is following:

While Venezuela does sit on the biggest oil reserve, that’s pretty much it. Their product has a high production cost.

Saudi Arabia has a similar reserve which means that both parties’ reserves are insignificant when deciding who is in a position of power. The Saudi’s supply is highly elastic which means that in the short term they can influence the market like no other supplier can. On top of that they have a low production cost.

If you are in a position of power, wouldn’t you want to pursue your own self-interest? It is in Saudi Arabia’s best self-interest to kill future competition. I’m referring to the production and technological advances of Shale oil production. If on a PPC curve you interpret crude oil as “consumer” and shale oil “technology” with market prices as high, I assume that it’s economically profitable to produce and research the technology of shale production that eventually will push the PPC curve to the more technological side. Therefore, it’s in Saudi Arabia’s best interest to kill the technological advance by producing even more from the “consumer” side, making it less profitable to waste resources on the “technology” side.

Why do OPEC members remain under the tyrannical rule of one hegemony? They are pursuing their own self-interest, meaning that MB>MC in the matter of being a member of OPEC.

As Saudi Arabia continues to produce more barrels to equal out the declining price, this will reach a point i which it will not be profitable to keep producing. So this will cause them to shut down and the rest of the world will have to rely on the rest of the countries to produce. With this action taking place, it will create a domino effect that will not benefit the rest of the countries in no way, shape, or form. In fact this will hurt them in the long run. Is this just a way to prove that bigger and greater countries can function without supporters? (Which they cannot) The driving force is self interest for one's nation. In the short run, this seems most beneficial. However, these nations, and countries will be in big regret if they do not cooperate.

-Alexander Shields

The price of oil has been a controversial topic for many years because it has caused frustration amongst drivers. The fact about oil is that the demand for it will always be increasing. It is important that OPEC continues to have it's supply meet it's demand. Obviously the company wants to continue to impress and please consumers, however with the constant decline of the prices, eventually profits will decline due to the elasticity of the price of oil within the company. I think if OPEC did not exist, there would be no means in the sales of oil worldwide. This makes the company extremely vulnerable for destruction. If other companies decided to take reign of the oil company, then they amy not be as successful as they are with OPEC as the main company. If all the other oil companies in the world base their prices off of OPEC and OPEC shut down, a much smaller company could never have the effect that OPEC has on the world.

The price of oil has been a huge part of the economy, multiple economies. As Saudi Arabia floods the economy buy selling more and more barrels of oil they are creating an increase in price. Between 2013 and 2015, non-OPEC countries increase production of oil and the price of oil drops to almost 50 dollars a barrel. As the prices drop, Saudi-Arabi increase production which than, in turn, increases their share in the market. Demand for the product oil will always be increasing since it is a finite material. With this being said i believe it is important that as the demand increases the price of the product should increase since oil is not an infinite source and will always be a necessity in our world. If OPEC were to ever get run out of the market than the world's oil economy will crash and no company will be able to bring it back up to where it is.

In the article, the fact that there are about 5 countries that are "...the OPEC members most vulnerable to political turmoil as cheap oil hammers their currencies and weakens their ability to sustain social subsidies..." concerns me, mainly because of the fact that not only are those countries prone to political upheavals and things along those lines, but we, the United States, will most likely start up a random (and most likely unneeded war with them over oil. And the fact that oil is roughly $50 a barrel now and has the chance of going down to even $20 a barrel can cause an even higher chance of war not only between the U.S. and one of the OPEC countries, but fighting within the OPEC countries as well. As mentioned in the article, the OPEC countries do have a tendency to fight. Hopefully, OPEC will be able to tough everything out and become stable.

-Elizabeth Piper Phillips

OPEC is a great example of the oligopoly markets that exist in our time. They orignially came together to collude by stabilising the prices and outputs of oil in ways that would benefit all of them. Even though they collude it is evident that they all have different cost structures, meaning that each of them produce their oil at different costs. This fact is was has brought about the unhappy cooperation of Algeria and Venezuela. With reference to Venezuela they have the largest amount of oil reserves in the organization however the cost of extraction is so high that its difficult for them to sell it at $50/barrel. Saudi Arabia on the other hand can afford to sell its oil at a low price because they have low costs of extraction and numerous investors who can help improve the production of oil. Because of this fact Saudi Arabia is as the most productive nation and is all the leader of the organization. Since their main goal is to increase quantity traded the supply factor of doing this is increasing supply which results in a shift of the supply curve and a lower price of oil. And because not many other oil producing countries can do this they are aware of the possibility of gaining majority market share. This article is a good source to show how a collusion of industries can go wrong becasue of one or more of the industries becoming selfish.

For 6 years now oil has been on an all time low. Oil is a huge chunk of our economy, especially because its in high demand around the country due to the demand of cars. Saudi Arabia's mass production of oil is making its price decline and that is essentially hurting our economy. If production drops then the price will increase that will help better the market.With Opec the economy is good

-Marvin Jean-Baptiste

This story describes the internal war between the members of OPEC. Venezuela's oil minister is arguing and pleading for fair and low prices on oil for all OPEC members to agree to. Venezuela wants to keep the organization sustainable because it is afraid the competition will plummet it. Algeria beckons Venezuela's desire for new prices as well. OPEC oil has been low for 6 years now. However the 1.7 trillion barrels of oil to be extracted, 1.2 are owned by OPEC members. The future sees OPEC carrying the demand for the world on oil and prices. OPEC is trying to change its structure and its market to be able to withstand the demand for the future. Its interesting to see that OPEC reached out to non member oil exporters like Russia and Mexico, who both said no. Saudi Arabia is the King of OPEC. They control the oil market prices and flood the market with their high surplus. This blog relates well to what we have been discussing in class. If you put the oil on a supply and demand curve you can see that there is no happy equilibrium. Countries could break into huge political wars over the $50 barrel of oil to $20 a barrel. Oil makes up a huge part of OPEC's economy and I am interested to see what happens in the future.

-Nicholas Lewis

This article is about how members of the OPEC are not on the same page as each other and unhappy. They look to their top producers Saudi Arabia to save the oil prices that has been dragging the Venezuelan economy to an all time low. On September 10th Venezuela’s oil minister talked about making prices fair, to ensure sustainability. Venezuela had back up from one of there members Algeria. Algerian Prime Minister Ahmed Benbitour says “OPEC is of no use today. The reason he says this is because the war is about market share and his people are getting no benefits from the organization. Algeria would like to stay part of the OPEC but they just feel like their sis no point. I agree with it what is the point of staying if the whole group is starting to lose the meaning of what they had started and you are not getting any benefits, there is no point. Although I do notice that the OPEC is trying to change their markets to hold up against the demand for the future. If OPEC can stick to what they are doing and change then I see them being successful and stable in the near future.

Like most people, I have to pay for gas for my car which means I benefit from low gas prices caused by Saudi Arabia flooding the market. However, this dilemma is affecting the world's economy, especially those that export a lot of oil. Venezuela for example, is angry that Saudi Arabia is flooding the market because now they have to compete with their low oil prices. I liked the analogy used in the article about how OPEC is like children who can't get along but also rely on each other. In this situation, Saudi Arabia is sort of like the big brother because they're controlling most of the market supply for oil.If they could all control their oil supply so that no country is distributing more than another, I think things would work out better.

The article explains how the countries that are a part of OPEC no longer are working together or agreeing with each other in terms of market sharing and setting prices on the oil economy. I believe that if OPEC were to no longer exist the oil industry would struggle greatly but without the cooperation of OPEC members, they will not benefit from the production of oil as much as they could. The Venezuelan economy has hit an all time low as a result of the prices set on oil by Saudi Arabia. I think Venezuela's intentions of setting a fair price on oil for all nations would be a step in the right direction if OPEC countries want to see prosperity and receive the benefits that being a part of OPEC can offer. Saudi Arabia has taken over most of the oil industry and by doing so they have disregarded all other OPEC nations, who are now struggling as a result of not being able to compete with Saudi Arabia's economy.

In this article the problem that was occurring consisted of different people being apart different groups which ultimately caused a split in the OPEC. There is different advantages such as us in america wanting lower gas prices we would like the Saudi Arabians to be apart of the market tremendously. With the Saudi Arabians taking a tremendous roll in the market this creates competition for other countries. This competition is too great for some countries to compete with as shown in this passage with Venezuela. Ultimately in my opinion Saudi Arabia controlling most of the market allows the market to become more simplified. The less countries that are in the easier the concept there is understanding the market. But there will definitely be struggle with other countries because of their lack in being able to compete.

-Nikolas Fountis

I believe that OPEC is an awful group of countries. None of them work as an organization. They are too selfish. If they really acted like an organization, then they would actually understand whats going on. They need to understand they indirectily control war throughout a few countries. If I a were a member of OPEC and had the slightest bit of knowlege about how low our member's pricees were getting per barrel I'd have my own plan. My plan would be too have every OPEC country raise their prices by the same percentage. This is so they all stand in the same place of sales in comparison to them and it will make them more money. If Saudi Arabia helped the economy of other countries out by raising their prices a little bit then it would help with compition and thier demand would still rise because of the more and more drivers and genorators and many other things that still need their oil.

- Matthew Golden

In this article it describes that the price of oil is something that’s been a big problem for so many years because it affects a lot of individuals today. Since we always need oil the demand is always going to be increasing. The Venezuelan people are struggling the most. With their economy suffering because of Saudi Arabia setting prices on their oil. Venezuela just wants to make the oil prices lower so it can be more fair for other countries. Saudi Arabia has taken over the oil industry and does not care about how is affecting other OPEC nations.

- Chelsy Ventura

This article talks about the effect of the Organization of The Petroleum Exporting Countries (OPEC) on various countries. When reading this article it is quite clear that it has had a negative effect on these various countries. This had been an ongoing problem for quite some time now. With oil being a product which is always a high constant demand, it is very important for all these countries to be able to work together in order to keep this industry running and keep the supply as high as the demand. The article also discuss how the price of oil has decreased overtime. In 2014 the price a barrels was $50 which is half its level a year ago. It then eventually decreased from $50 to $20. The OPEC needs to figure out a way to resolve the issue and figure out how to make the OPEC a well running now business, because as of right now it is falling apart according to Fayyad Al-Nima. He is Iraq's deputy oil minister. As of now there is a decision to be made for multiple countries. Either stay with the OPEC or leave the OPEC. Hopefully the OPEC will be able to recover and effect countries in a positive way.

-Surina Sandhu

The price of oil is a major controversial issue in the world. For many years the price of oil has been low. Oil is constantly in high demand because of the large amount of cars used around the world. Many members of OPEC are unhappy with each other. The Venezuelan economy is at a downfall because of the oil prices set by Saudi Arabia. Venezuela wants to see a fair oil price set for all nations. I believe a price set for all nations would be a good step for OPEC. OPEC members are not benefitting from oil production, but without OPEC the oil industry would suffer immensely. Hopefully, the members of OPEC will be able to get along and have a positive affect on the nation.

-Jane Kasparian

The main concern of this article is the effect that the OPEC and its members have on countries around the world. Oil is a product that is inelastic because the demand for oil will always be there regardless of how low or how high the price is. This doesn't differ in a wealthy country like the US because people have proven that though the oil prices are high the demand is still high as well. But recently prices have been extremely low because Saudi Arabia is able to produce barrel after barrel of oil which in turn is driving the price down. This has upset countries who can not produce as easily such as Venezuela because they aren't making a significant profit due to the low prices. Many countries have purposed possibly setting a standard price to protect all countries but unfortunately that will not happen because it would hurt the countries who can produce the oil for lower prices.

Recently the price of oil has decreased tremendously and I believe that it will continue to do so. Because of the price being so low the consumer demand has increased. Yet, many countries believe it might not be worth producing oil because there has been a cut in price of producing oil because the increase of demand isn't as high as they would like. They believed that this would re-stablize the price of oil yet only thinking about the consumer demand.

Oil is a major part of ones economy and while oil prices fluctuate so does ones economy. OPECis the largest international distributor of oil. This article is a explaining that as OPEC's prices decrease Saudi Arabia's Oil prices increase. I was very confused with this process due to the fact that this counters the law of supply and demand. Both Saudi Arabia and Venezuela have a large amount of oil reserved. The difference between the two is that the price of production Venezuela has is much higher than the price of production that Saudi Arabia carries. Venezuela, because of this is very upset with Saudi Arabia as it continues to monopolize its market.

Finally, I believe that there will be no positive outcome if these two "family members" don't work on the same page.

This articles main idea is about oil and how this product is highly inelastic. Oil is an inelastic product because almost everything in life runs on oil and without oil everybody's usual daily routines would not be the same anymore. Oil is inelastic because no matter how high the price may be (like early last year) people will purchase the product. Saudi Arabia has recently discovered new oil mines in there land making the product of oil high in quantity. Like any other product in the economy when there is a lot of a product the price of it declines to sell more of the product. As the discovery of more oil was found prices in gas dropped. The economic market shows that in a competitive market where goods are of the same quality and use customers are obviously going to buy whats cheaper. Many countries were not happy when Saudi Arabia found more oil and dropped the price because than other countries with less quantity in oil did not have enough to drop the prices in oil and make a profit. This increased the sales of Saudi Arabia oil and decreased other countries oil sales. Countries have now tried to come together to create a standard price to oil so everyone in the oil market can share a close to equal profit but the potential of that happening is slim to none. The oil industry is a competitive market that has been created into a monopoly multiple times in past decades. There is no "fair" way to distribute a product so valuable to everybody.

Post a Comment