Comments due by Oct. 30, 2015

When the Federal Open Market Committee decided in September to leave its main policy rate where it’s been for seven years—close to zero—it included an extraordinary detail. According to the “dot plot,” the display of unattributed individual policy recommendations, one committee member believed that the rate should be below zero through 2016. That is, rates should go to a place the U.S. has never had them before.

In theory, it shouldn’t be possible for a central bank to keep short-term interest rates below zero. Banks would have to pay the Federal Reserve to hold reserves. Consumers would have to pay banks to hold deposits. Banks and people can hold physical cash, which charges no interest. This is why economists see zero as the lowest possible rate. It’s just theory, though; real-world experience shows the actual lower bound is somewhere below zero.

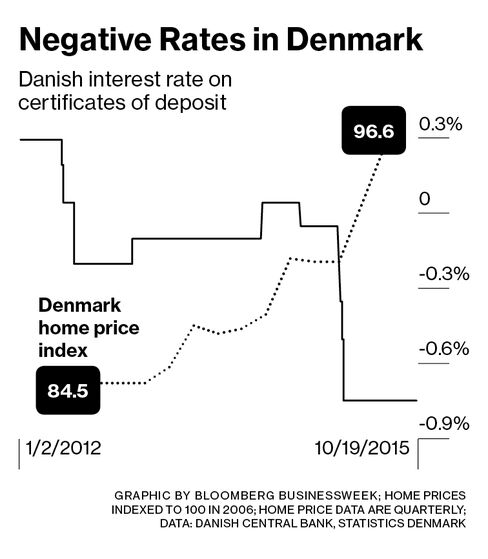

Denmark’s key bank rate dipped below zero in 2012 and is at minus 0.75 percent. Economists recently surveyed by Bloomberg see negative rates in that country continuing at least into 2017. Switzerland has kept the rate at minus 0.75 percent since early this year, and Sweden’s is minus 0.35 percent. These countries have a different monetary goal from that of the Fed. Denmark and Switzerland have been working to remove incentives for foreigners to deposit money in their banks. Massive foreign inflows would drive their currencies to appreciate so much they would become seriously misaligned with the euro, the currency of their main trading partners. Sweden has been attempting to create inflation.

The strategy has had some success. Denmark has been able to hold on to its peg to the euro. Switzerland dropped its euro peg, and after an initial runup, the Swiss franc has traded within a predictable band. Sweden’s inflation has seesawed.

In all three countries, banks were reluctant to pass negative rates on to their domestic customers. In Denmark deposit rates have fallen, and some banks have raised fees for their services, but “real rates for real people were actually never negative,” says Jesper Rangvid, a professor of finance at the Copenhagen Business School. The same is true for Sweden, according to a paper by the Riksbank, the central bank. In Switzerland, one bank, the Alternative Bank Schweiz, will impose an interest charge on retail deposits starting in January.

There’s no evidence of a flight to cash in any of the three countries. According to central bank data, Danish households have added 28 billion kroner ($4.3 billion) to bank deposits since rates shrank to their record low on Feb. 5. That’s because a sack of bills has to be stashed somewhere safe, and protection costs money. According to Rangvid, rates would have to drop as low as minus 10 percent before people start “building their own vaults.” In its paper, Sweden’s Riksbank pointed out the same possibility but declined to say how far below zero rates would have to go to trigger depositors’ exit from the banks in the largely cash-free country.

In the U.S., Narayana Kocherlakota, the dovish president of the Minneapolis Fed, has expressed support for negative rates as an option. (He’s likely the anonymous negative rate dot-plot guy.) So has John Williams of the San Francisco Fed. William Dudley of the New York Fed, a moderate, said during an Oct. 15 event that the FOMC had considered negative rates during the depths of the financial crisis. Experience in Europe, he said, showed that the unintended consequences of negative rates were “less than what people had feared.”

Since they dropped rates below zero, there has been no clear, consistent economic trend among the three countries. In Denmark asset prices have risen as Danes sought higher returns. Spurred by speculation, the local stock market has recorded more than twice the gains of the Stoxx Europe 600. Danske Bank, Denmark’s biggest lender, says Copenhagen is becoming Scandinavia’s riskiest property market, because of a surge in prices. Danish businesses have increased their investments only 6 percent; private consumption has risen 5 percent. According to Torsten Slok, Deutsche Bank’s chief international economist in New York and a Dane, negative rates “raise risks in the short term and do little more to help the economy than what can be achieved with bond purchases.”

In Switzerland there’s little sign of overheated property or stocks, or new consumption. Recently, Thomas Jordan, head of the Swiss National Bank, saw potential side effects but called negative rates an “important and unavoidable monetary instrument to weaken the attractiveness of the [Swiss] franc.”

All three countries have dipped below zero without massive withdrawals. That’s a valuable lesson for economists. But in Sweden, it’s too early to tell whether negative rates have created inflation. And in Denmark and Switzerland, this tool has succeeded only in its precise and limited purpose: to manage exchange rates with the euro. That finding will be of limited value to the Fed.

—With Peter Levring, Nick Rigillo, and Catherine Bosley

17 comments:

The article talks about economists dropping the interest rates below zero and the effects that this has on inflation and the economy in certain countries. In Denmark, it seems as if dropping the interest rate to minus .75% in 2012 had little effect on the efficiency of the economy and in some aspects it improved it. The debate in the United States is whether or not for banks to allow the option to drop the interest rates below zero. According to the article, numerous United States representatives of the Fed are in favor of dropping the rates. They don't think that the effects have as much damage as people are anticipating. The only representatives that are concerned are the Swiss because it can potentially weaken their attractiveness. In my opinion, it doesn't seem as if dropping the rates will have that bad of a concerning effect on the economy. The only real issue would be if doing this raised inflation rates, however there is no real way of proving that could happen yet, because there is no common trend in the countries who have dropped the interest rates. I think it is a risk that we should be willing to take because the benefits that have been proven through study have shown to have helped improve the economy.

It's interesting to see how interest rates around the world affect different currencies. Like how in Denmark, they dropped the interest rates and they came out fine, but here in the U.S., half of us are scared of that change while the other half wants to take the plunge. Every country's economy is different, yet they are all connected enough that if one country goes either into a recession or a depression, others go down with it. That's probably one of the reasons why the US is so scared- that, and the risk of inflation going crazy and we become pre-WWII Germany. That has to be our #1 fear in this whole situation. But even then, it's hard to tell that will happen to us if we don't take the chance that Sweden, Denmark, and those guys took.

-E. Piper Phillips

When ECB lowers the interest rate of the Euro, they are trying to encourage investment. They want a cheaper currency so that businesses get more from their money in the Euro countries than outside of the Euro countries. These outside countries that fight for the same resources in order to grow must battle the weakening of the Euro by weakening their own currency in order to maintain resources.

This article entitled "Negative Interest Rates" discusses whether having interests rates below would be better for the economy. The article provides examples of different countries who have interest rates below zero. It is very interesting to see how a negative interest rate affects the economy of these countries. Countries who have a interest rate below zero are Denmark, Sweden, and Switzerland. Although some countries have seen the economy become more efficient because of this decrease in the interest rate, not all countries have gained efficiency. An example of this is Denmark. With Denmark dropping their interest rate below zero to a -0.75% they have not seen their economy become any more efficient. The article also discusses how the United States has been going back an forth about rather or not to make their interest rates below zero. I believe that the U.S. shouldn't make a change because the study in the article doesn't improve the efficiency of the economy. Taking this risk may not Help improve the efficiency of the U.S> economy.

-Surina Sandhu

If banks choose to cut their interest rates to below zero, it could potentially backfire on them because less people will deposit their money. Examining the economies of the countries that gave it a shot, I would say it isn't worth it. It did not seem to have a large affect on Switzerland and Denmark, and one can only assume that the same will happen to Sweden. Why would anyone want to make a deposit if their savings would just end up decreasing? If it were my decision, I would not drop interest rates below zero because the risk-reward just isn't worth it.

This article named "Negative Interest Rates?". It talks about economist dropping interest rates below zero. I think that this is a bad idea because countries like Denmark and Switzerland tried doing this and they didn't have the best results. If you drop interest rates then your just letting your money sit in the bank and just decrease.The article also shows this. It would weaken our currency

-MarvIN JEAN-BAPTISTE

This article is about how the federal open market committee decided to leave its main policy rate in September even though it had been there for seven years. What people in the committee are saying is that the rates should be below 0 in 2016, which might be hard because the U.S. has never seen that before. It also says that banks will also be keeping short-term interest rates below zero. That is not a good idea because if that were to happen people will stop giving their money to the banks because there would be no point in doing so. Some countries decided to give this and chance such as Denmark, Sweden, and Switzerland and it did not turn out so well for them. In my open I do not think that the U.S. should try this because it did not work for other countries. Even though we are not those it is still a risk I am not willing to take.

I dont think that the banks in the Uninted States are going to be willing to drop their interest reates below zero. The banks are very gready and if they drop below zero then many people could stop investing their money through them. Also, we cant compare other country's banks that have tried this to ours because its like apples and oranges. The Switzerland banks are being flooded with deposits of money coming from outside their country. We, the U.S. can not compare to that because we don't have that problem with our banks. All in all, between gready banks, not having a flood of deposits from outside our country coming in, and people not wanting to invest thier money to watch it decrease, I do not think that dropping our interest rates below zero will be positive.

-Matthew Golden

This article talks about countries and there different approaches to bank interest rates and what America may be moving towards. A negative interest rate means the central bank and perhaps private banks will charge negative interest, instead of receiving money on deposits, depositors must pay regularly to keep their money with the bank. This is intended to banks to lend money more freely and make businesses and individuals invest, lend, and spend money rather than pay a fee to keep it safe. Many countries have done this because it keeps a constant flow in the economy and forces people to do something with there money. None of the research done after these changes show stabilization or big enough success to per sway me to want this change in the United States. This actually makes me feel like the world is starting to want to transform into a cash only place and force people to pay for banks to hold there money or people are going to feel inclined to spend it. From graphs in the article and graphs I have researched every country seems to be working towards the 0% rate which seems to be one day everyone's end result.

If the United States were to lower interest rates, it would cause a panic amongst american citizens. The stock market would likely crash and people would lose a lot of money and possibly some faith in the government. Negative interest rates would lead to possibly lest investment in banks. Although this policy of negative interest rates have worked in other countries, since when is the United States a follower? It is a superpower which is supposed to be a leading nation coming up with policies for other nations to follow. A reason why the negative interest rates work in these smaller countries is because there is more desire to increase production to make more money.

-Nick Arciszewski

This article talks about economists dropping the interest rates below zero. If banks were to do this, less people would choose to deposit their money in those banks. After looking at the countries that have already tried to do this, I believe it is a bad idea. Denmark and Switzerland did not have the best results after dropping the rate to below zero. If you were to deposit your money into a bank with an interest rate below zero then you would slowly watch your balance decrease without withdrawing any money. This would have no positive outcome and would weaken our currency.

-Jane Kasparian

Studies have shown that negative rates may create financial instability. Banks may be reluctant to pass negative rates on to depositors, lest they lose customers to other financial institutions.For institutions in that position, negative rates would lead to lower profits and, eventually, to erosion of capital. Damaged financial institutions are unlikely to power a rapid recovery.The boldness of the move to negative interest rates could convince consumers that central banks are serious about beating deflated or lead them to conclude that even zero cannot keep inflation and interest rates from tumbling.

This article talks about how the US is trying to follow some steps for interest rates below zero. While it may look like a good idea it may seem that less people will likely deposit their money in banks. Two countries Denmark and Switzerland have already done this and it has shown that it is not a good idea because while the interest is low and when you deposit without taking any money out you will loose money most likely. But this is most likely to cause panic in the united states and the stock market will crash. Since the US is good economy standards in a way some of this low countries will work because they have the need to make money.

-Manuel Llivisaca

This article discusses the US lowering interest rates. In my opinion it’s a bad idea because people are not going to want to deposit money into banks anymore of fear of losing it. People would not want to invest money from banks. Even though there are countries like Denmark and Switzerland did this it was said that it did not have a large affect on them. People are not going to want to deposit money if all they are doing is losing it at the same time.

- Chelsy Ventura

The article discusses lowering the interest rates below zero in the US. That would be a really bad move to take in my opinion, most people will cut their relationships with banks and no one will be willing to invest their money. As it always said in class "Investment" is a crucial part in any economy,so with no one willing to invest it would be a harsh hit to the economy even though some countries who have tried lowering the interest rate below zero said it didn't do that much damage. I think it will cause chaos here and won't end up with positive results.

This article discusses the United States lowering the interest rates in America. This is a terrible idea because to keep a bank up and running you must have customers. In my opinion I believe that the bank's customers would not continue to bank with a bank that has zero or even less than zero interest rate. The United States would make a poor decision in lowering the income rates. Not only would it be a terrible idea to invest in for the economy but banks would be running out of business with the lack of customers and people would be aggravated.

The lowering of interest rates will make most investors and customers not see or even feel a benefit with the banks. Without investors, banks will not have money to be able to lend to customers that need money for loans and mortgages. If this process is lost the nation will fall and will not be able to survive without the banks.

-Alexander Shields

Post a Comment